Sep 23, 2021

DeSpace Staking Guide

With a token comes staking, and we’re excited to introduce our staking model and release this guide on the different ways you can earn yields on your DES. This is a massive milestone for us, so read on to learn about DES token staking and LP token staking on DeSpace Protocol.

In this article we cover:

🚀 An overview of staking DES tokens

🚀 An overview of staking LP tokens

🚀 How to stake on DeSpace

🚀 How to add liquidity to PancakeSwap

🚀 How to add liquidity to Uniswap

Staking DES Tokens

DES tokens can be staked as single assets to earn more DES tokens as rewards. As these rewards are paid from a token allocation to the smart contract, staking will only be possible while there are rewards available on the balance of the contract. Rewards are sent directly to the user’s wallet when they’re claimed. 💸

Single staked DES has a minimum lockup period of 48 hours, although rewards can be claimed at any time. Claiming rewards within 48 hours of staking sends the user 85% of the total amount, while returning 15% to the rewards pool. Claiming these rewards after 48 hours of staking means the user gets 90% of the rewards, while only 10% is sent to the rewards pool. Unstaking tokens also claims any outstanding rewards.

You’ll love the APYs on our pools, which will be halved at regular intervals until an equilibrium is reached. Check our live app for the most recent figures.

Remember: DeSpace NFTs have utility within the ecosystem! Depending on the NFT that you have, it may be possible to boost your rewards. 🚀

- Stake lockup = 48 hours

- Reward split = 85% user, 15% reward fund, if claimed within 48 hours of staking

- Reward split = 90% user, 10% reward fund, if claimed after 48 hours of staking

We’ve also added extra single-asset pools with slightly different rules. Stakers on certain networks now have the ability to join pools with no stake lockup periods and the ability to increase their stake without unstaking first. These pools have different APYs from those with lockups, so make sure you double check which pool you’re staking in before you confirm!

Staking LP Tokens

In addition to single asset staking, users will also be able to farm rewards with LP tokens. We’ll prepare a list of eligible LP token addresses that can be staked, which will be shared across our channels in addition to being saved on the staking contract itself.

Rewards for LP token stakers will be paid in DES to the user’s wallet, with APYs calculated by formula. Just like with single asset staking, certain DeSpace NFTs can augment your rewards! Make sure you’re keeping an eye on our NFT marketplace so that you can maximize your staking rewards. 💰

There is no minumum lockup for LP token stakers, so the stake can be withdrawn at any time. Any unclaimed rewards will also be sent upon unstaking, but users also have the option to claim their rewards at any time while staking. Claiming rewards within 48 hours of staking sends the user 85% of the total amount, while returning 15% to the rewards pool. Claiming these rewards after 48 hours of staking means the user gets 90% of the rewards, while only 10% is sent to the rewards pool.

- Stake lockup = None

- Reward split = 85% user, 15% reward fund, if claimed within 48 hours of staking

- Reward split = 90% user, 10% reward fund, if claimed after 48 hours of staking

How to Stake

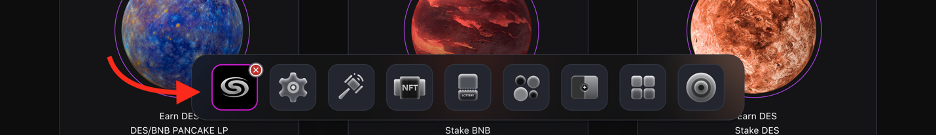

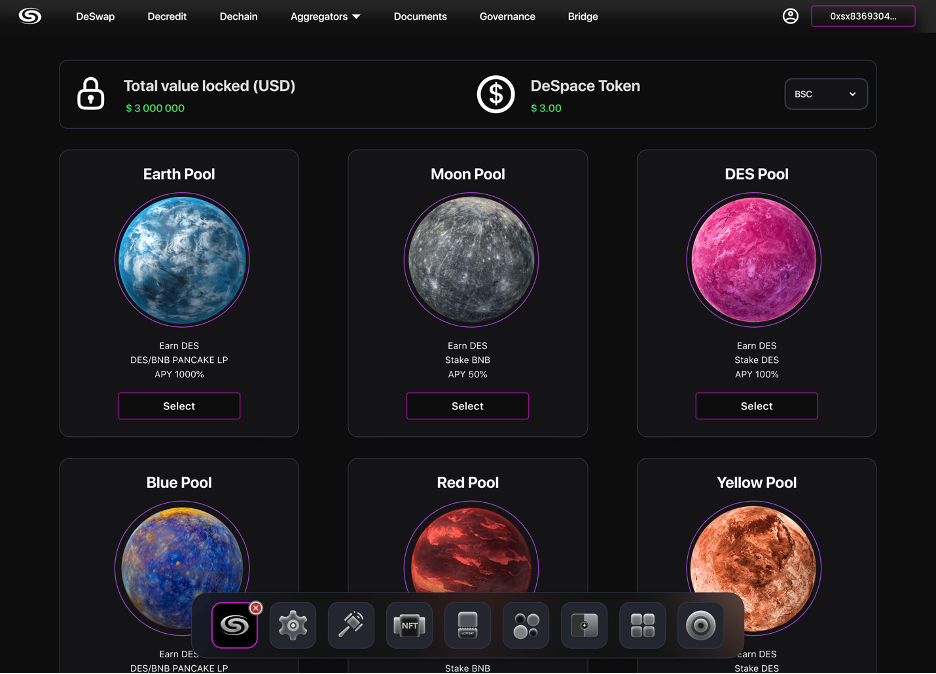

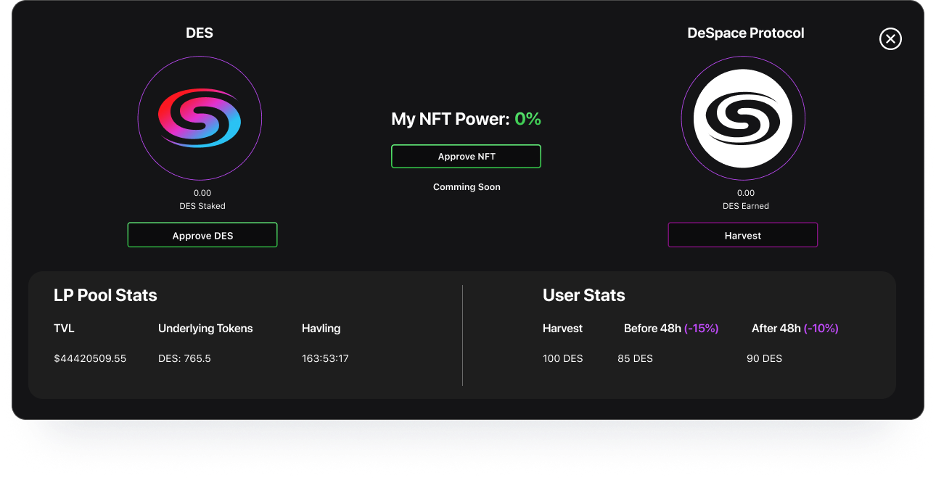

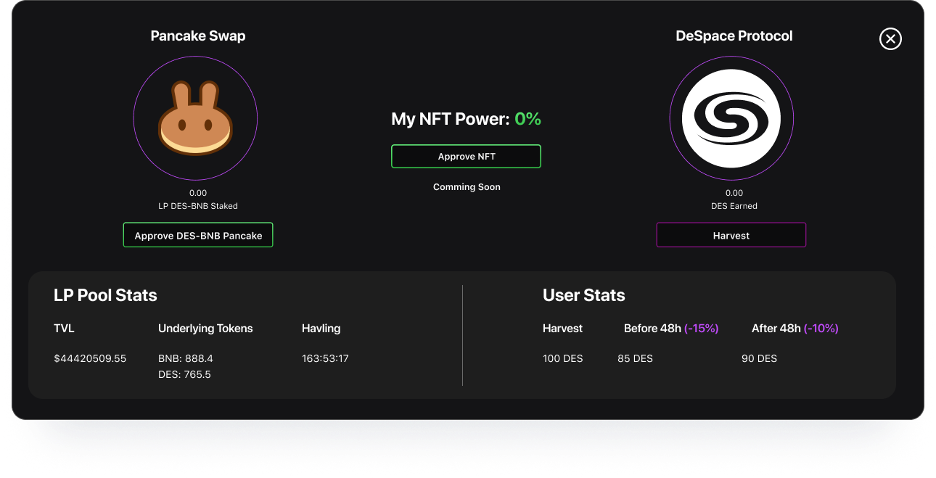

Here is a look at what staking will look like on DeSpace Protocol. As the app is in continuous development the actual interface might change with time.

Remember, these images are mockups. Always check live prices, APYs and contracts first.

You can navigate through different ecosystem features with the bottom icon menu. To go to staking, select the first option.

Here you’ll find a list of the supported staking pools. Before adding liquidity to any DEX, make sure you check that the pool address matches the contracts listed here.

If you’d like to stake DES as a single asset, select that pool to go to its staking menu. You’ll need to approve the contract before depositing your DES into it.

From this menu you’ll be able to see all the important details, including the current APY, time until the next halving, your unclaimed rewards and any NFT multipliers you have active. From here you’ll also be able to unstake after the minimum lockup has ended.

How to get LP tokens

To stake LP tokens, you first need to get them! We’re launching on PancakeSwap and Uniswap first, and other DEXs on other chains will follow shortly.

Remember, always double check that you’re trading on the correct token addresses. If you need to import the DES ticker into your exchange, use the addresses below.

Ethereum

0x634239cfa331df0291653139d1a6083b9cf705e3

Binance Smart Chain

0xb38b3c34e4bb6144c1e5283af720e046ee833a2a

PancakeSwap LP

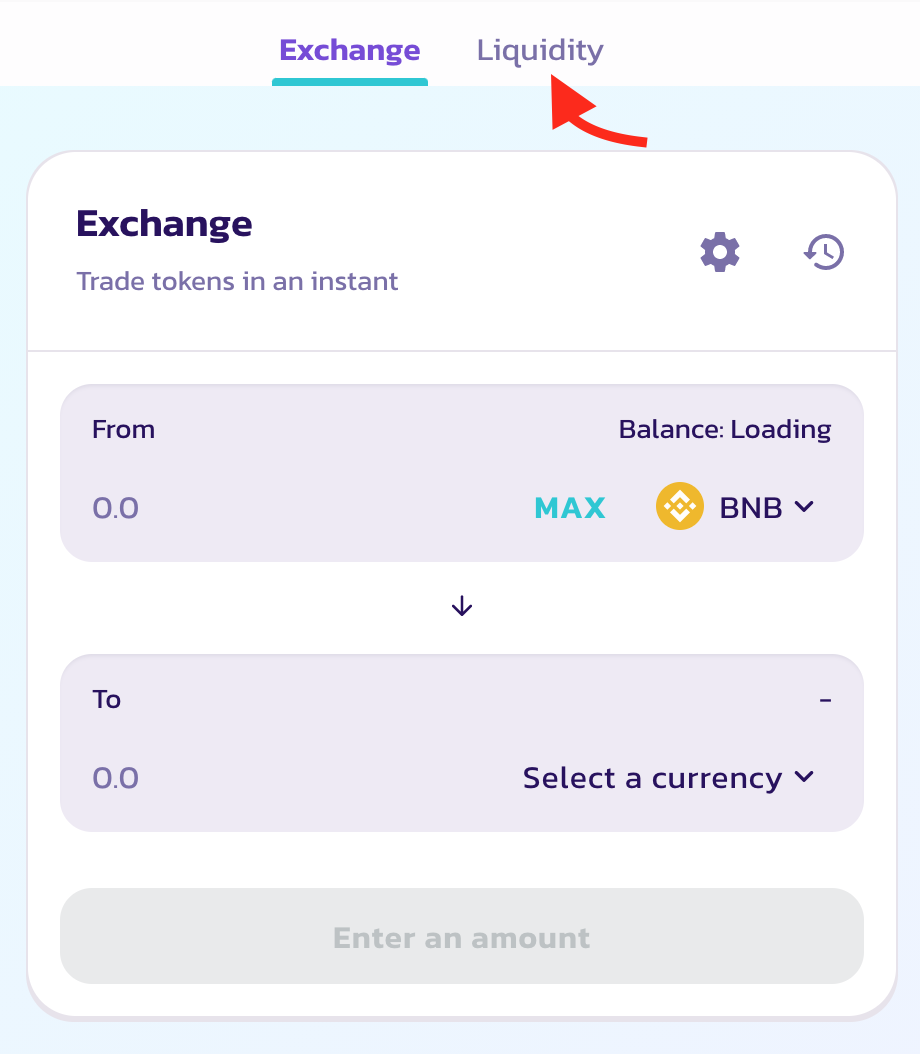

First, navigate to the LP contract. You can copy the pool address directly from its DeSpace staking page, or you can navigate there manually by going to PancakeSwap and selecting ‘Liquidity’.

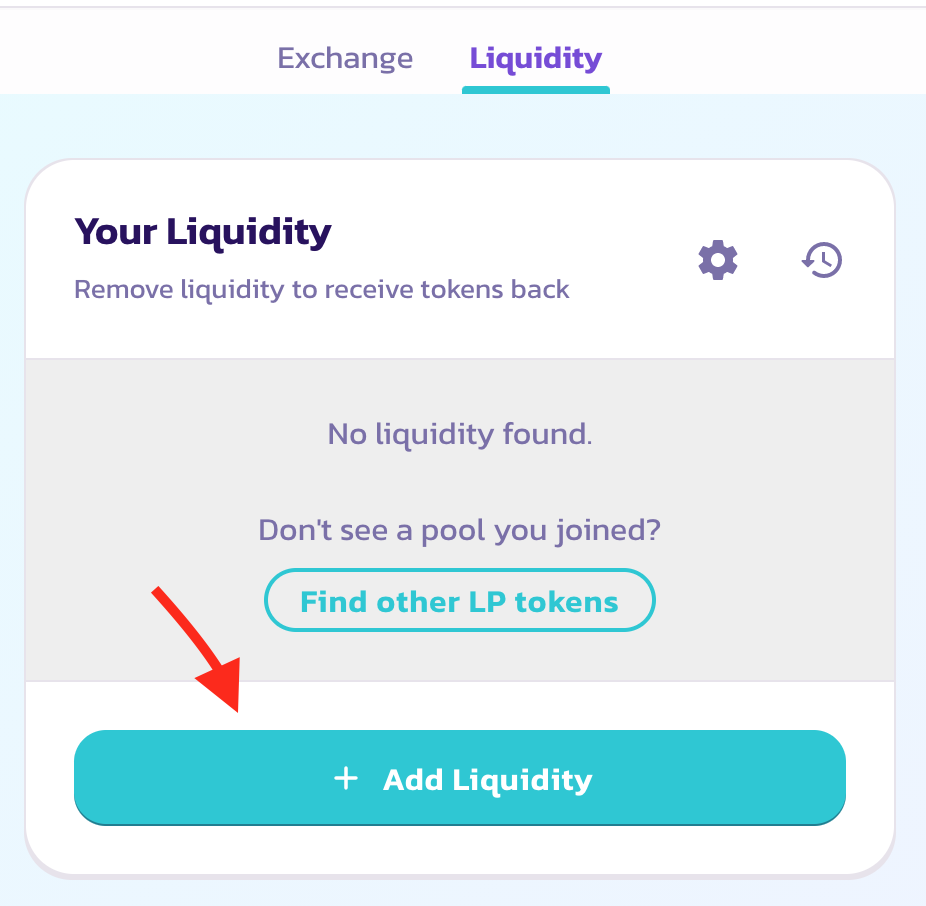

From here, select ‘Add liquidity’.

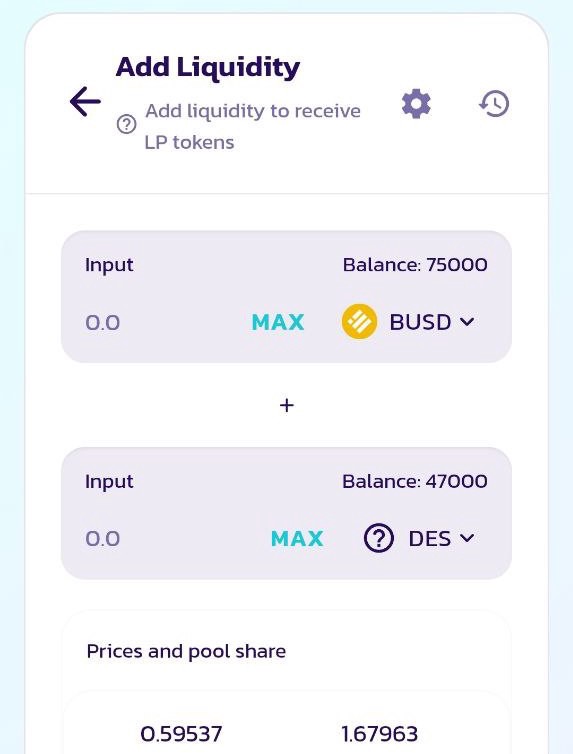

You’ll then need to add liquidity in a 1:1 ratio. Ensure that you have enough of both tokens in your wallet and ‘Enable’ the transaction.

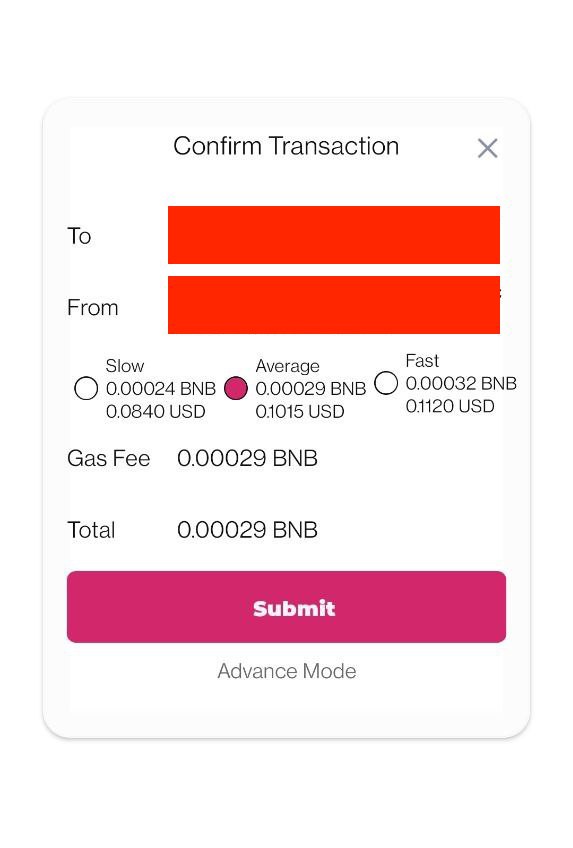

This will make you approve a transaction through your wallet, normally costing a small amount of gas.

Once it’s approved and everything looks good to go, hit ‘Supply’ and confirm the transaction. The tokens you’re supplying will be taken from your wallet, and you’ll receive an amount of LP tokens in their place. With these in your possession, head back to DeSpace.

Uniswap LP

Providing liquidity to Uniswap V3 has a few more steps than Pancake swap, but the process is still fairly similar.

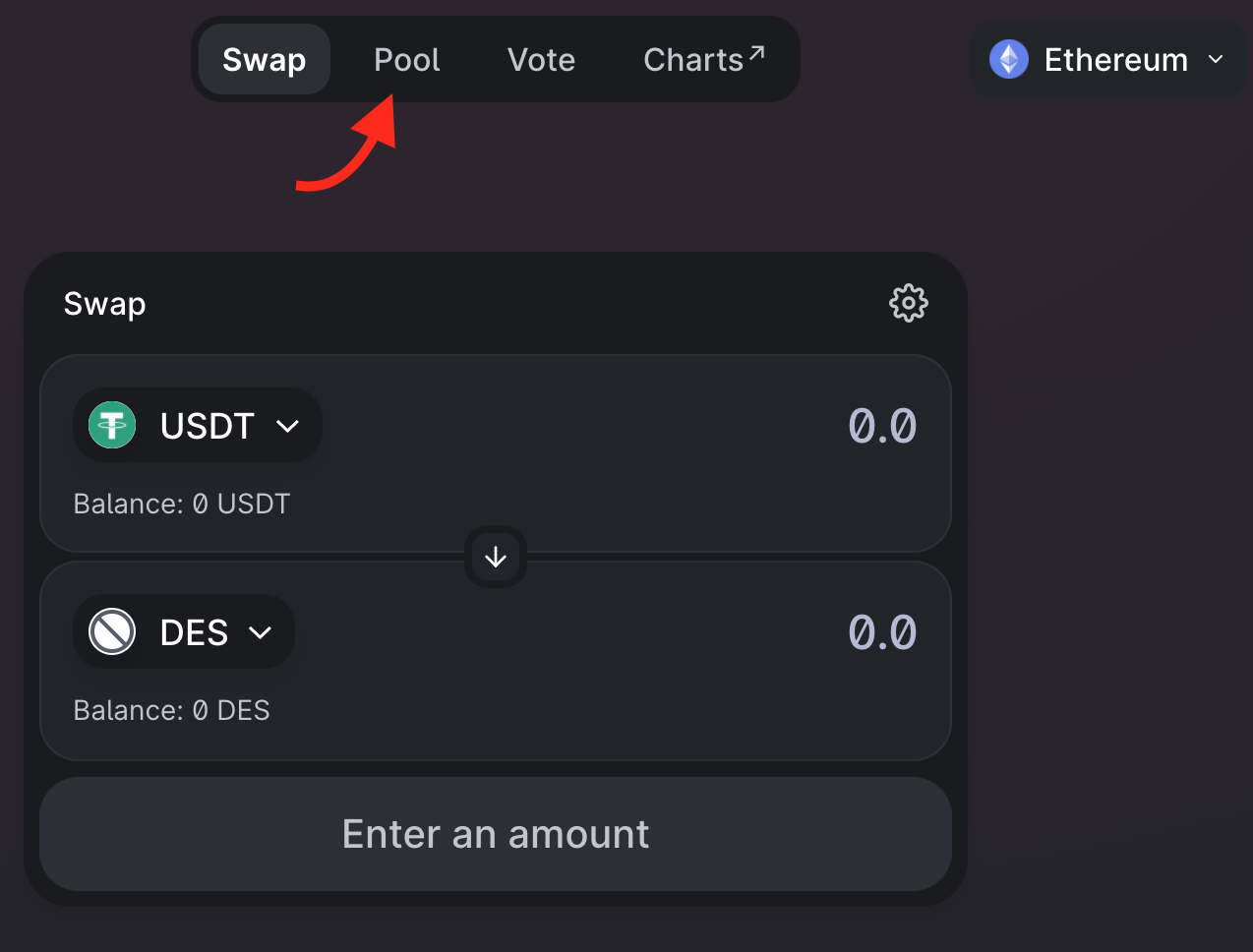

First, connect your wallet and navigate to the pools section in the Uniswap interface.

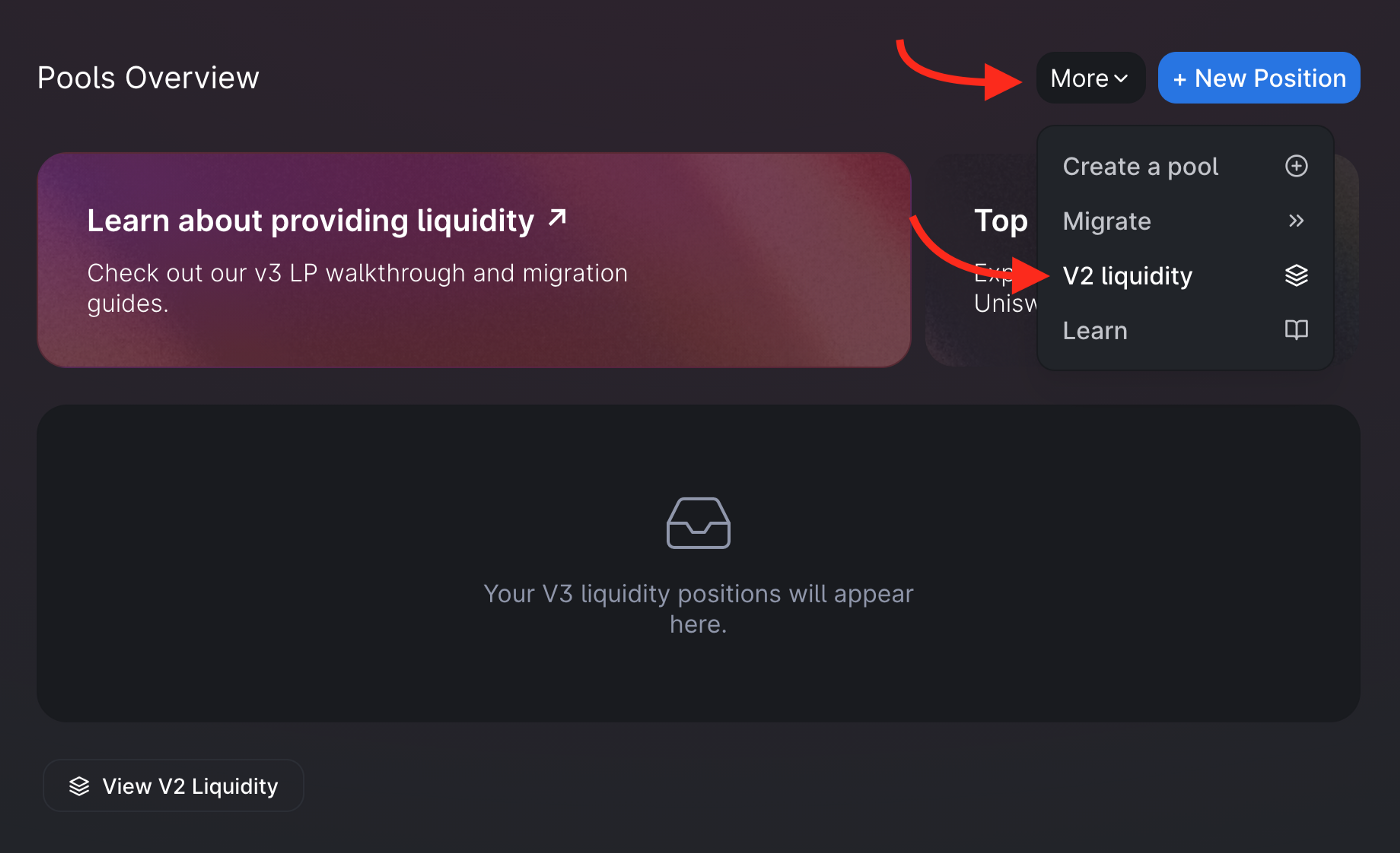

Next, select ‘More’, and then ‘V2 liquidity’. Our liquidity is currently on V2, but if this migrates we’ll update our staking guide.

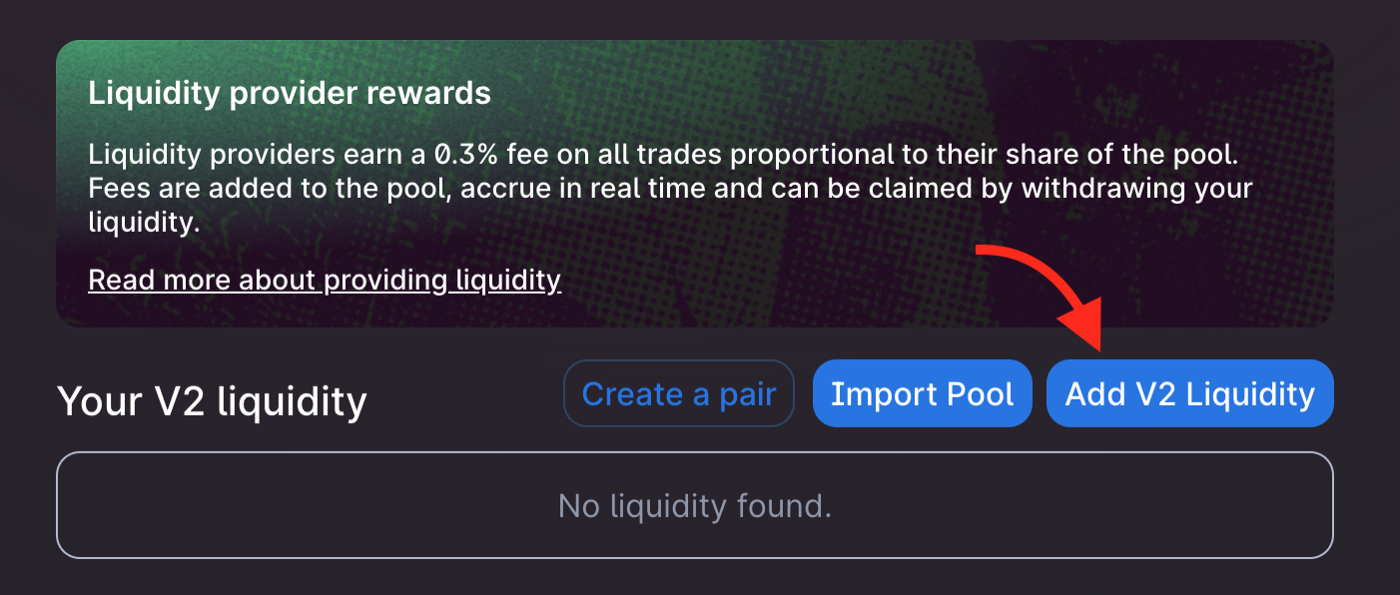

From the V2 liquidity interface, select ‘Add V2 Liquidity’.

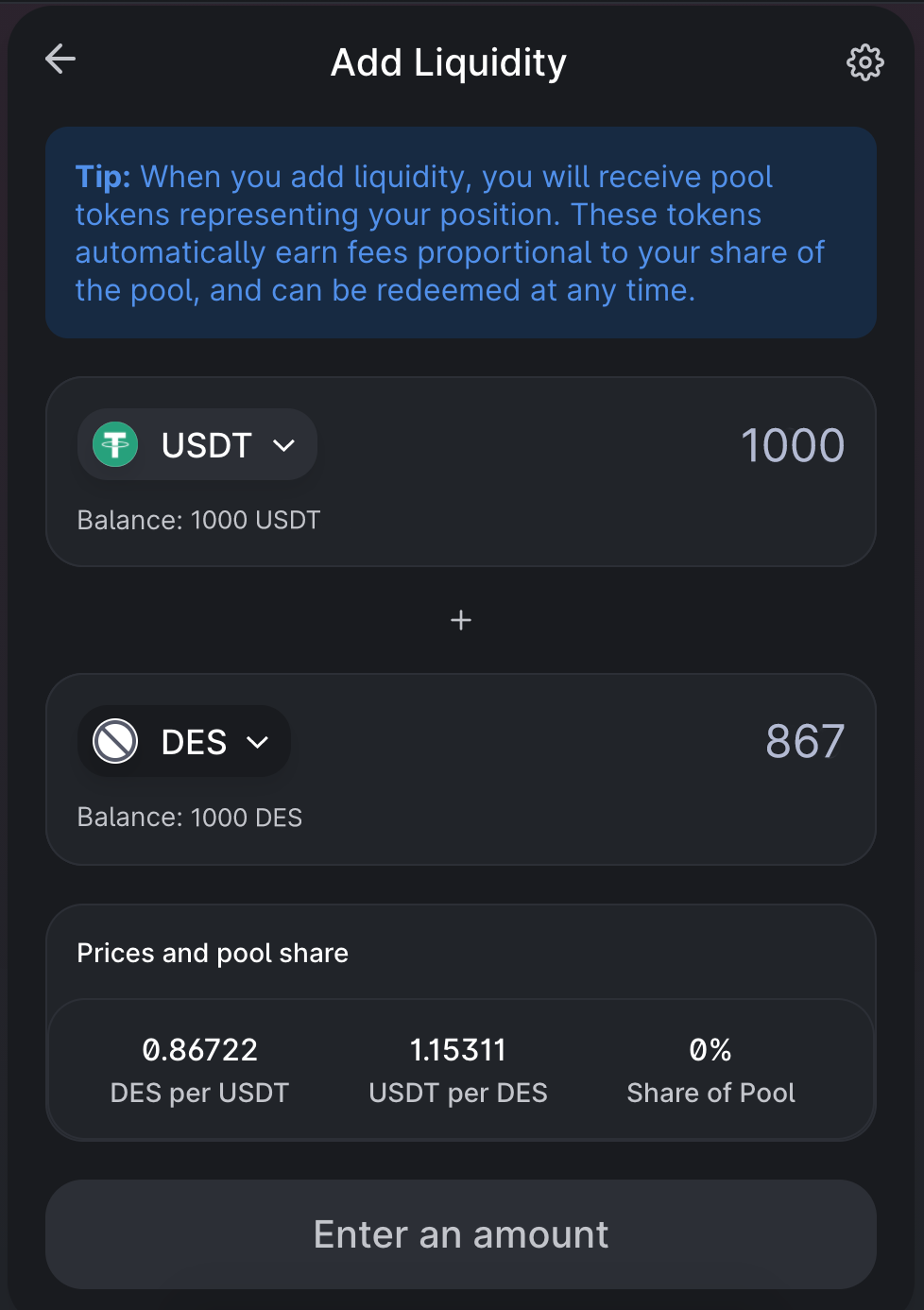

From here, you’ll be able to add liquidity in much the same way as with PancakeSwap. Add tokens in a 1:1 ratio, click the supply button, approve the transaction in your wallet, and finally confirm the liquidity provision. With the LP tokens, head back to DeSpace.

Staking LP tokens on DeSpace

Staking LP tokens is very similar to staking single assets. From this menu you’ll have access to all the same information regarding APY, unclaimed rewards and NFT multipliers.

These staking options are just a tiny part of what DeSpace will become, and it’s amazing to share this milestone with our incredible community. From the DeSpace team: thank you as always, and make sure you’re following us for even more exciting updates!

The DeSpace Team 🚀

Learn more about DeSpace Protocol👇

💥Website | 💥Telegram Community | 💥Telegram Announcements | 💥Twitter